SAN DIEGO (KGTV) -- A new study by Zillow shows that homebuyers with lower credit scored pay more for the same homes than buyers with excellent credit scores.

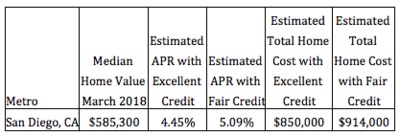

According to Zillow, borrowers with excellent credit scores could get a mortgage with a 4.5 percent annual percentage rate.

Borrowers with a fair credit score could get a 5.1 percent rate. Over the lifetime of a 30-year mortgage, that means a buyer with a fair credit score may end up paying an additional $21,000 over the lifetime of the loan.

In San Diego, where the median home value in March of 2018 was $585,300, Zillow estimates that homebuyers with fair credit will pay $64,000 for the same home.

The difference is only amplified in more expensive markets, Zillow says. In addition, the penalty for lower credit scores tends to be higher.

"When you buy a home, your financial history determines your financial future," said Zillow senior economist Aaron Terrazas. "Homebuyers with weaker credit end up paying substantially higher costs over the lifetime of a home loan. Of course, homeowners do have the option to refinance their loan if their credit improves, but as mortgage rates rise this may be a less attractive option."

Zillow says that even if homeowners don’t pay the full 30-year term on a loan, the annual cost of a lower credit score can still add up to $700 a year.