SAN DIEGO (KGTV) — The San Diego County Board of Supervisors on Tuesday approved a property tax relief initiative for January flood victims whose homes and businesses were destroyed by flood waters.

Shane Harris, the president of the nonprofit People's Association of Justice Advocates, spearheaded the initiative with the help of Jordan Marks, the county's Tax Assessor. The goal was to give flood victims some extra time and money to pay their taxes this year.

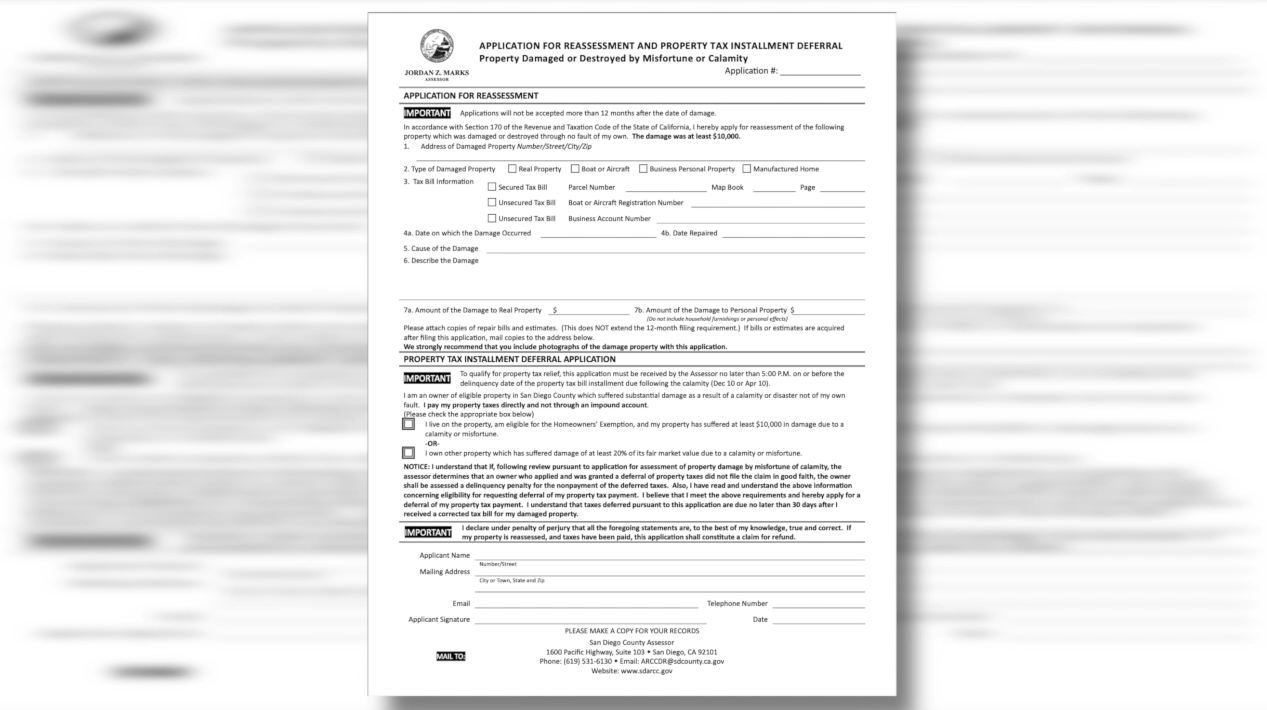

Here's how the initiative works: If a flood victim's home or business was either damaged or destroyed, they can apply for reassessment of that property in its damaged condition.

Once it's reassessed, the property taxes that have to be paid on it will be adjusted.

Eligible property owners, meaning their properties sustained 20% or more of damages, can also apply to have upcoming payments deferred.

In addition to the county's property tax relief initiative, the IRS has extended the deadline for impacted San Diegans to file their federal income taxes until June 17.

The IRS is doing this in conjunction with FEMA's presidential disaster declaration.

It is still unknown if the state of California will offer the same extension for San Diegans to file their state-income tax returns.

In the meantime, Marks made the following recommendation:

"I would take the April deadline when you make your property tax payment, and I would take it to when your permit is finalized on your reconstruction. And when that's done, you'd have 30 days to pay your property taxes," Marks said. "This would apply to homes that have $10,000 or more damage, and it would also apply to businesses where 20% of the value or more of the property is damaged. So that could be multifamily units, it could be commercial properties that are agricultural or also manufacturing as well."

The board will give the ordinance a second reading on March 12. If there are no adjustments, it will be officially adopted that day.