SAN DIEGO (KGTV) — Saving for college has long been a priority for families, but recent changes to popular 529 savings plans are giving parents more flexibility in how they use those funds.

The tax-free savings accounts, specifically designed to help families save for educational expenses, previously could only be used for college or K-12 tuition. Now, following recent legislation, the funds can cover a broader range of educational costs.

The expanded uses include high school AP tests, college exams, tutoring outside of school, and other career programs. Perhaps most significantly, the plans now cover training and certification for skilled trades and vocational careers.

"The training and certification for skilled trades and vocational careers, that is huge, commercial driver's license, plumbing. Electrical work, welding, HVAC, cosmetology, those are all covered," said Thomas Boles, president and owner of Telesis Tax & Financial in Mission Valley.

Boles recommends starting early with consistent contributions. A monthly deposit of $50 to $100 can add up over time, he said.

"The earlier the better. And also instead of getting the presents that sit in the closet for a year and then go to Goodwill, you have have a relative send a $50 donation or not donation but a deposit to the program," Boles said.

Boles opened an account for his daughter years ago. They were able to use those funds to help offset some of her college expenses, which totaled more than $30,000 per semester for out-of-state tuition.

"We are out of state tuition ... and per semester it was over 30,000," Boles said.

"That's tuition and books and just anything that would be covered under this ... all of that would be covered," Boles said.

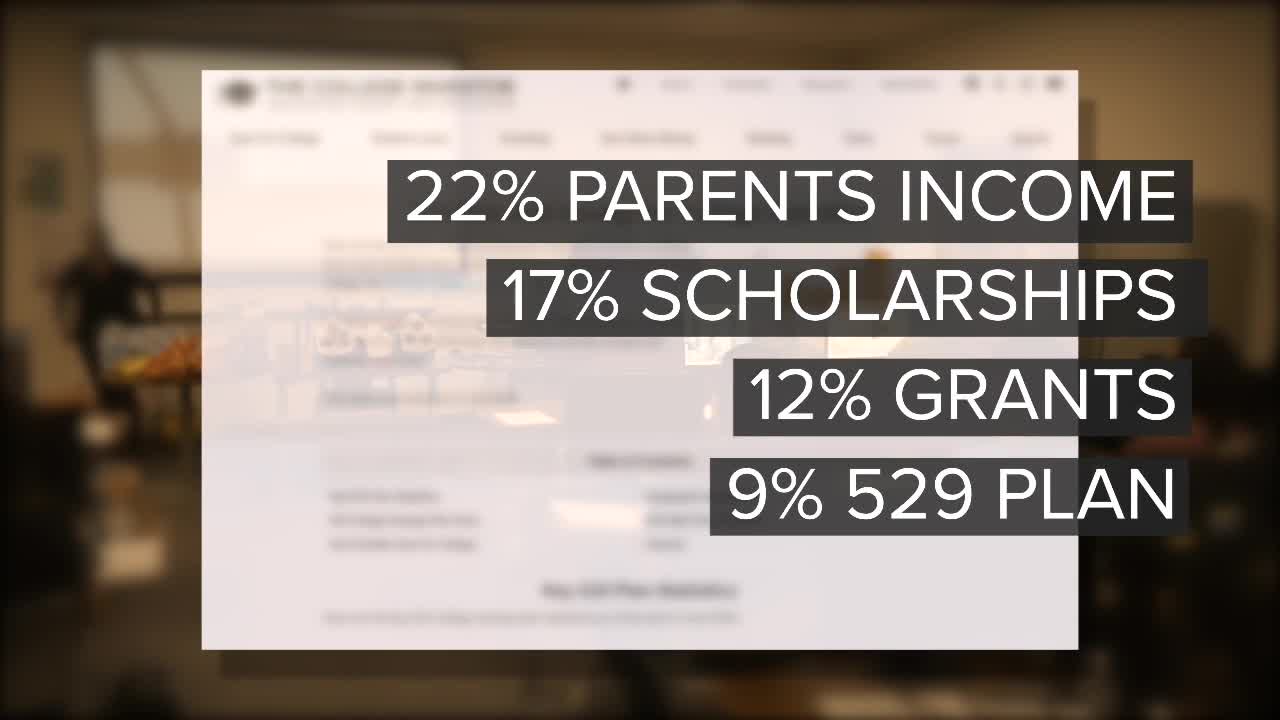

According to The College Investor, 22% of students rely on their parents' income to pay for college, while 17% use scholarships, 12% use grants, and 9% use college savings plans like 529 plans.

For families interested in opening a 529 plan, Boles suggests looking online for free resources or consulting with a financial professional.

"Almost every financial organization has, has some sort of program for the 529, and they will, they'll basically follow in line with any rules and regulations that are put out with new legislation," Boles said.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.